MEET PRIDE.

If This Venue Can’t Get Insurance — No One Is Safe

The case that proves Australia’s small business insurance market is broken.

A community-owned venue.

Zero insurance claims.

Five-star compliance.

And a 2,500% insurance increase.

If this can happen to Pride — it can happen to any small business in Australia.

Why Pride is the “Bambi” of the industry

Pride of Our Footscray Community Bar isn't a nightclub chain.

It isn't reckless.

It isn't high-risk.

It's a 200-capacity, community-owned venue that exists to support:

Local musicians and performers

Queer and marginalised communities

Comedy, poetry, theatre, drag, and live music

It's owned by ~200 local shareholders, not corporate investors.

Its success depends on safety, trust, and compliance — not excess.

If the insurance system were working, Pride would be rewarded with lower premiums.

Instead, it's being punished.

The Safety Record Insurers Ignore

By every objective measure, Pride is low risk

- Zero insurance claims — ever

- Five-star Liquor Control Victoria rating (maximum possible)

- Police, council and regulator approval for late-night trading

- Professional security, CCTV, RSA enforcement

- Plastic glassware, floor stewards, strict capacity controls

In a functioning market, this is the definition of a “best-in-class” risk.

Over 8 years of trading.

Hundreds of thousands of patrons.

Not a single claim.

What “market failure” actually looks like

Yearly Annual Public Liability Premium

-

$2020

-

$2022

-

$2024

-

$2024 - Financed TotalThe 2024 figure is already unaffordable.

Pride had to seek finance just to pay it.

To Put That Into Basic Terms:

-

$3,022 every weekJust to stay insured

-

$75 per trading hourBefore staff, rent, or stock

-

~13% of total revenueInsurance alone

This isn’t pricing risk.

It’s pricing extinction.

-

Exorbitant costs are pricing venues out, with many being asked to pay 10 to 20 times more for public liability insurance, meaning for some venues a single insurance bill is nearly double the yearly rent for their whole building.

-

Venues are being flat-out denied public liability insurance, even when they don’t have a single claim to their name.

-

Insurance over the actual buildings that house the venues is being cancelled, which is as absurd as it sounds.

-

Patrons are being left vulnerable, with venues unable to provide their patrons with public liability insurance cover, which is the definition of a broken system.

-

Closure, forced sale or bankruptcy is becoming routine, as venues cannot operate without public liability insurance—and insurers know it.

-

Material revenue declines are mounting, as public liability insurance is required for many grants, events and festivals—turning opportunity into a locked door.

-

Funds are being drained out of the industry into insurance company profits whilst venues & artists struggle, and the punchline is that the ‘protection’ is increasingly unavailable.

-

Insurers are attempting to enforce rules such as ‘all patrons must be seated’ or ‘no dancing if drinking, even on carpet’ that directly contradict the nature of the venue itself, which is like insuring a pool by banning water.

-

We’re seeing insurers cash in on musicians and drag artists in corporate and brand advertising whilst refusing to insure their usual places of work.

-

Enforced raising of drink prices is decreasing the likelihood of patronage, as venues try to cover the new premiums by turning every round into an insurance surcharge.

WHEN INSURERS WALK AWAY ENTIRELY

This section shows what market exit looks like: insurers don’t price the risk — they refuse to participate.

What withdrawal looks like

This isn’t “risk pricing”

A ~$150,000 public liability premium is commonly associated with:

Comparable industries

- Demolition and explosives contractors

- High-rise construction sites

- Hazardous materials handling

- Motorsport and extreme sports operators

The builder pre-fills most of it — personalise the details in minutes

The Building Insurance Contagion:

A Second Front

The crisis is not confined to Public Liability Insurance (PLI). The facts details a disturbing new trend: the contagion of "uninsurability" spreading to commercial property insurance, affecting landlords and neighboring tenants.

The WFI Cancellation (2023)

In August 2023, the landlord of Pride of Our Footscrays premises received a cancellation notice from WFI, a brand owned by Insurance Australia Group (AIG) — Australia’s largest insurer.

Building insured only

Single stated cause

Targeted one tenant

Impact on Commercial Tenancy

This action by WFI weaponizes building insurance against the arts sector.

Commercial reality

Premium shock

Recoverable outgoings

Blanket exclusion

The Failure of Negotiation

Pride attempted to negotiate with IAG’s corporate affairs department, offering to modify its business model to retain coverage.

The "No Dancing" Ultimatum: WFI/IAG representatives eventually indicated that coverage might be considered only if Pride closed at midnight, reduced capacity to 100 persons, and removed the dancefloor.

This ultimatum reveals a fundamental misunderstanding of the business model. A venue cannot simply "remove the dancefloor" and halve its capacity without destroying its revenue base. The insurer effectively demanded the business cease to exist in its current form as a condition of insurance. This "take it or leave it" approach characterizes the unchecked power of the insurance oligopoly.

If Pride can’t get fair insurance

who can?

- Five-star compliance across every requirement

- And with this compliance backed by police, council and regulators

any small business can survive

when insurance becomes a gatekeeper to trade.

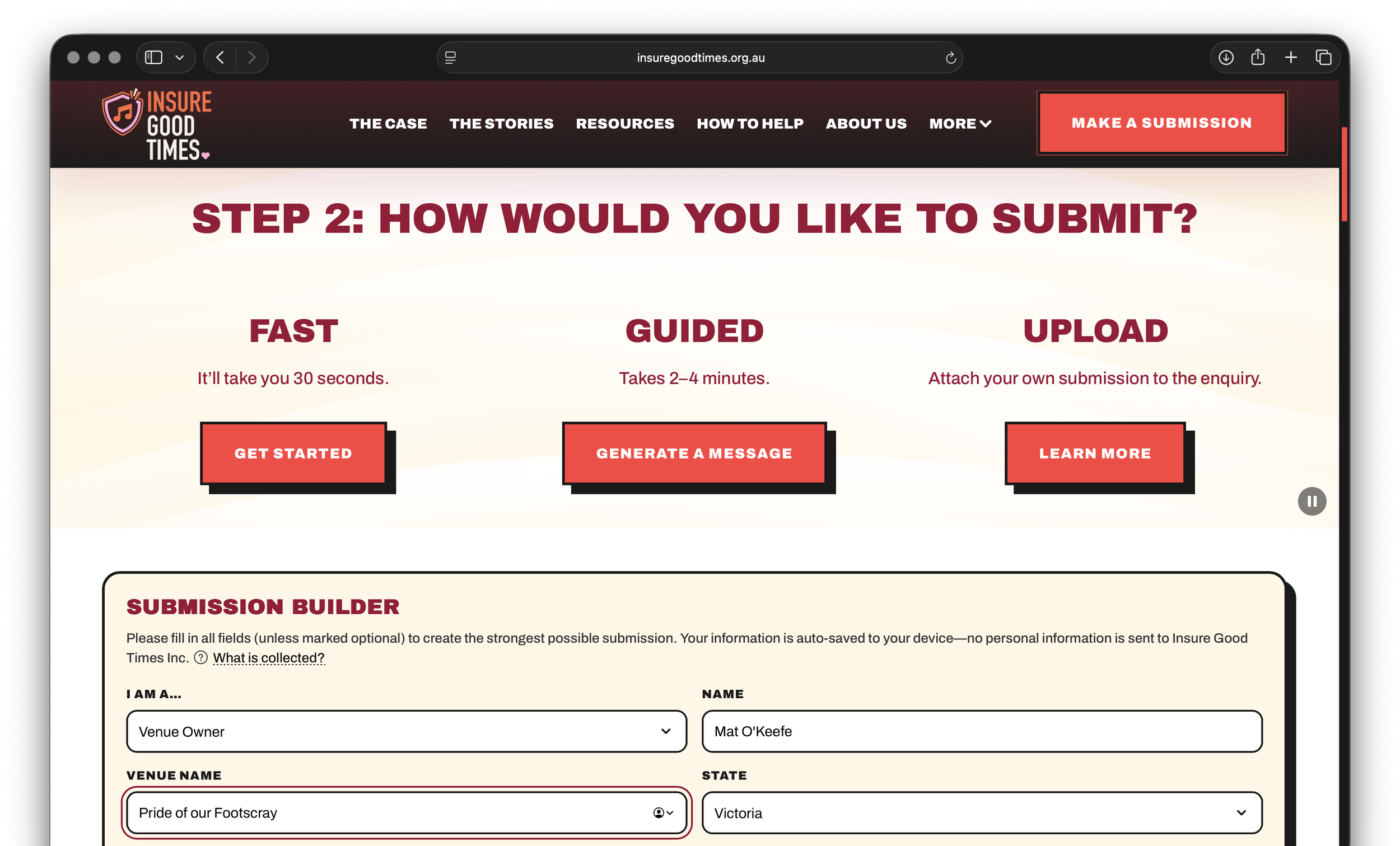

Your input matters.

Parliament doesn’t need another abstract complaint.

It needs proof.

Pride is proof.

Your submission:

turns one case study into thousands

shows this isn’t an “industry whinge”

forces government to confront a failed market

This inquiry exists because stories like this are impossible to ignore.

Submissions don’t need to be long. Hundreds of short submissions are more powerful than a few long ones.

It’s now or never. Let’s make your input heard in less than 5 minutes.

We are moving Parliament from

acknowledged problems → enforceable remedies

Recommendation 1: A Federal Statutory Insurance Scheme

Proposal: The Federal Government should establish a statutory insurance scheme for Live Entertainment Venues, modeled on existing no-fault schemes such as the Transport Accident Commission (TAC) in Victoria or the Accident Compensation Corporation (ACC) in New Zealand.

Mechanism: Venues would pay premiums into a government-managed pool rather than to private insurers. In the event of a personal injury claim (e.g., a slip and fall), the scheme would cover the cost of treatment and rehabilitation.

Rationale: The ACC model in New Zealand covers all personal injuries for residents and visitors, effectively removing the right to sue for damages in exchange for guaranteed care. A similar, sector-specific scheme for Australian venues would stabilize costs by removing the litigious profit motive from personal injury claims. It treats public liability as a social cost to be managed, rather than a financial product to be exploited.

Recommendation 2: A Discretionary Mutual Fund ( DMF )

Proposal: The Government should facilitate and capitalize a Discretionary Mutual Fund for the sector.

Mechanism: Venues pool their premiums into a mutual fund owned by the members. The fund pays claims up to a certain limit, with reinsurance purchased for catastrophic events. The board has the " discretion " to pay claims, allowing it to reject frivolous suits that commercial insurers might settle for expediency.

Precedent: This model was successfully used in NSW with " Statewide Mutual " when local councils were deemed uninsurable in 1993. It now covers 115 councils.

Government Role: The Federal Government should provide seed capital ( approx. $ 5m- $ 10m ) or a government guarantee to allow the DMF to meet APRA capitalization requirements and purchase initial reinsurance.

Recommendation 3: Expansion of the Federal Reinsurance Pool

Proposal: Expand the mandate of the Australian Reinsurance Pool Corporation ( ARPC ).

Mechanism: The ARPC currently backs terrorism and cyclone risks- areas where the private market failed. The mandate should be expanded to include " Public Liability for Cultural Infrastructure. "

Impact: Private insurers would continue to write policies, but the government would reinsure the " catastrophic tail " ( e.g., claims exceeding $5 million ). This removes the " uncertainty loading " that drives up premiums, allowing insurers to offer more affordable rates for the working layer of risks.

Recommendation 4: Legislative Compulsion ( " Must Offer " )

Proposal: Amend the Insurance Contracts Act to compel insurers to offer PLI to small businesses.

Mechanism: Insurers operating in Australia benefit from selling highly profitable products like home and car insurance. As a condition of their license to operate, they should be compelled to offer PLI to compliant small businesses. This obligation would prevent " cherry- picking " and force the industry to pool risk effectively.

Recommendation 5: License Buy- Back Scheme

Proposal: A dignified exit strategy for uninsurable venues.

Mechanism: If the government cannot fix the insurance market, it should fund a buy-back of liquor licenses for venues deemed uninsurable.

Rationale: State governments issue liquor licenses after rigorous checks, encouraging investment. If the insurance market renders these licenses worthless, the state has a moral obligation to compensate the business owners who invested millions based on those licenses. This could be funded by a levy on the insurance industry.

Recommendation 6: Immediate Emergency Grants

Proposal: A temporary "bridge" fund to prevent immediate closures.

Mechanism: A cost-sharing grant where the government subsidizes the "excess" premium (e.g., the amount above the 2020 baseline adjusted for CPI) while structural reforms are implemented. This prevents immediate insolvency for venues like Pride facing $150,000 bills.

Conclusion

The case of Pride of our Footscray, is a definitive indictment of the Australian insurance market. When a venue with a perfect safety record, a 5-star regulatory rating, and deep community trust is forced to pay $157,000 for a mandatory insurance product—a 2,500% increase in four years—the market has not just hardened; it has broken.

The insurance industry has effectively abrogated its social contract. It acts as a tax collector for the cultural sector, extracting unsustainable rents while offering no value in return. The result is a cultural and economic tragedy: the loss of jobs, the closure of community hubs, and the silencing of Australian voices.

This report implores the Parliament to recognize that the era of "market-led solutions" for this sector is over. The market has left the building. Government intervention is now the only mechanism capable of saving Australia’s live entertainment industry from extinction.

Further Information

For detailed information please read the first hand stories of hard working venue owners from all around Australia.

Stay in the loop

〰️

Stay in the loop 〰️

The performers featured on this page: Bathsheba,